Headline Inflation

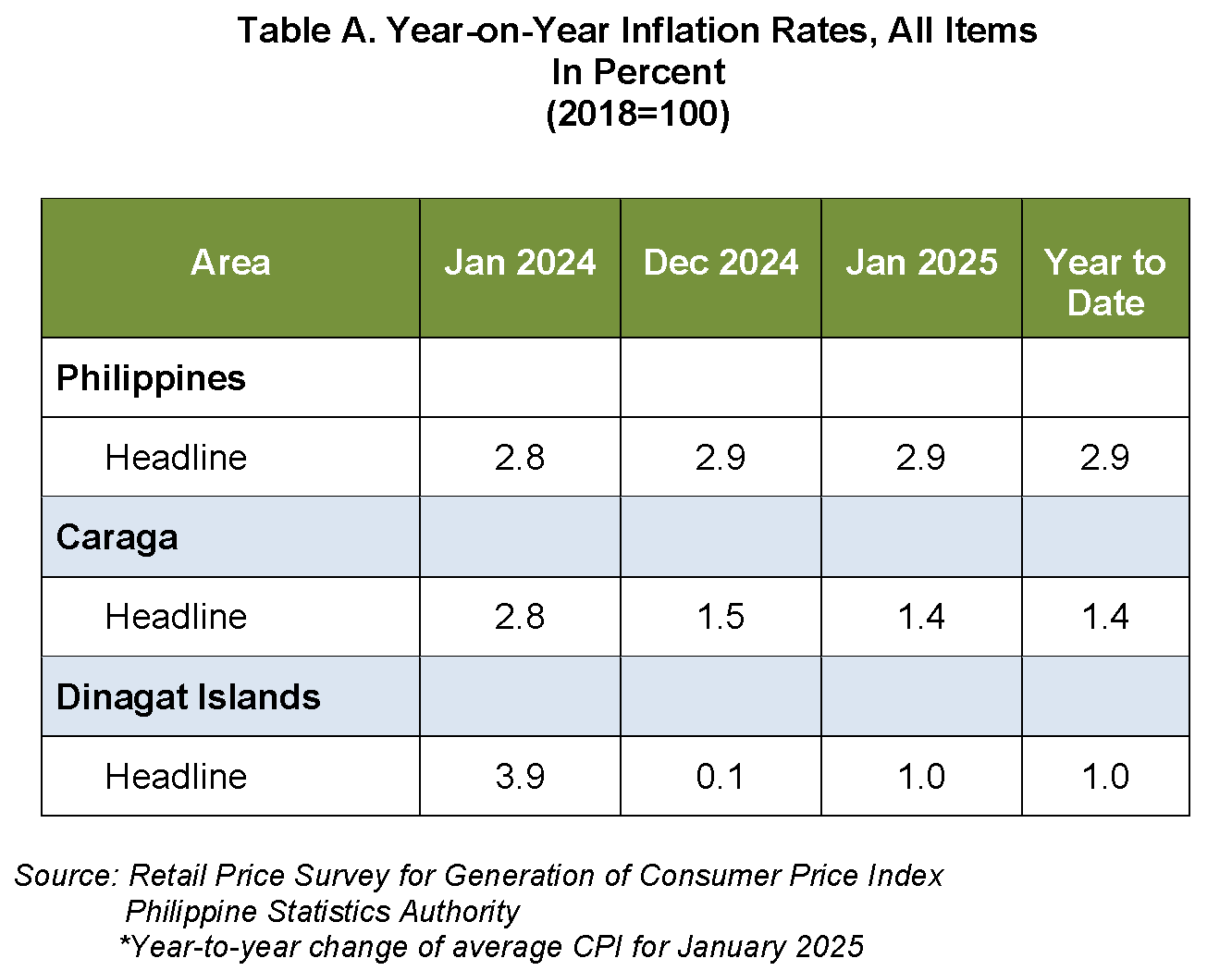

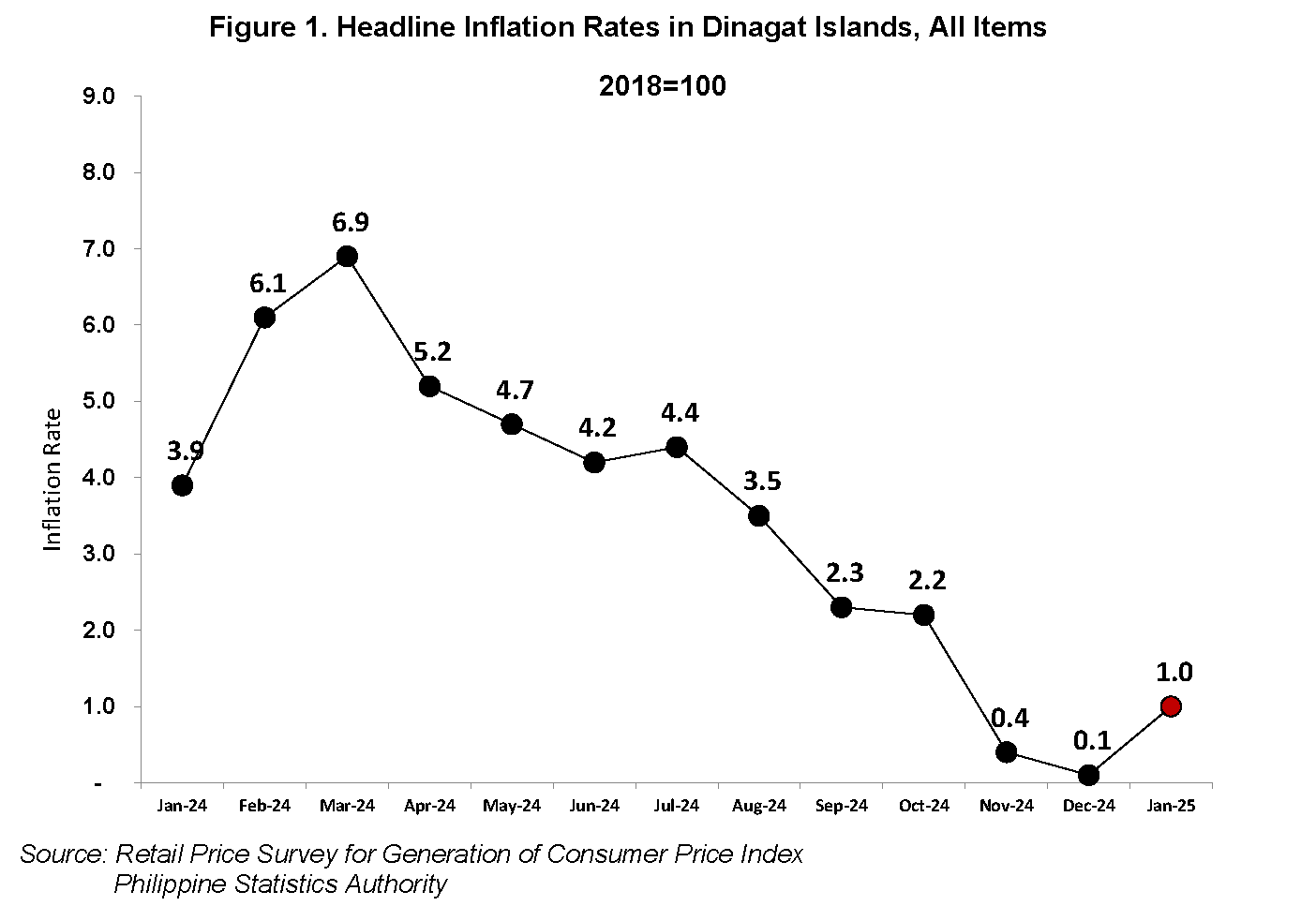

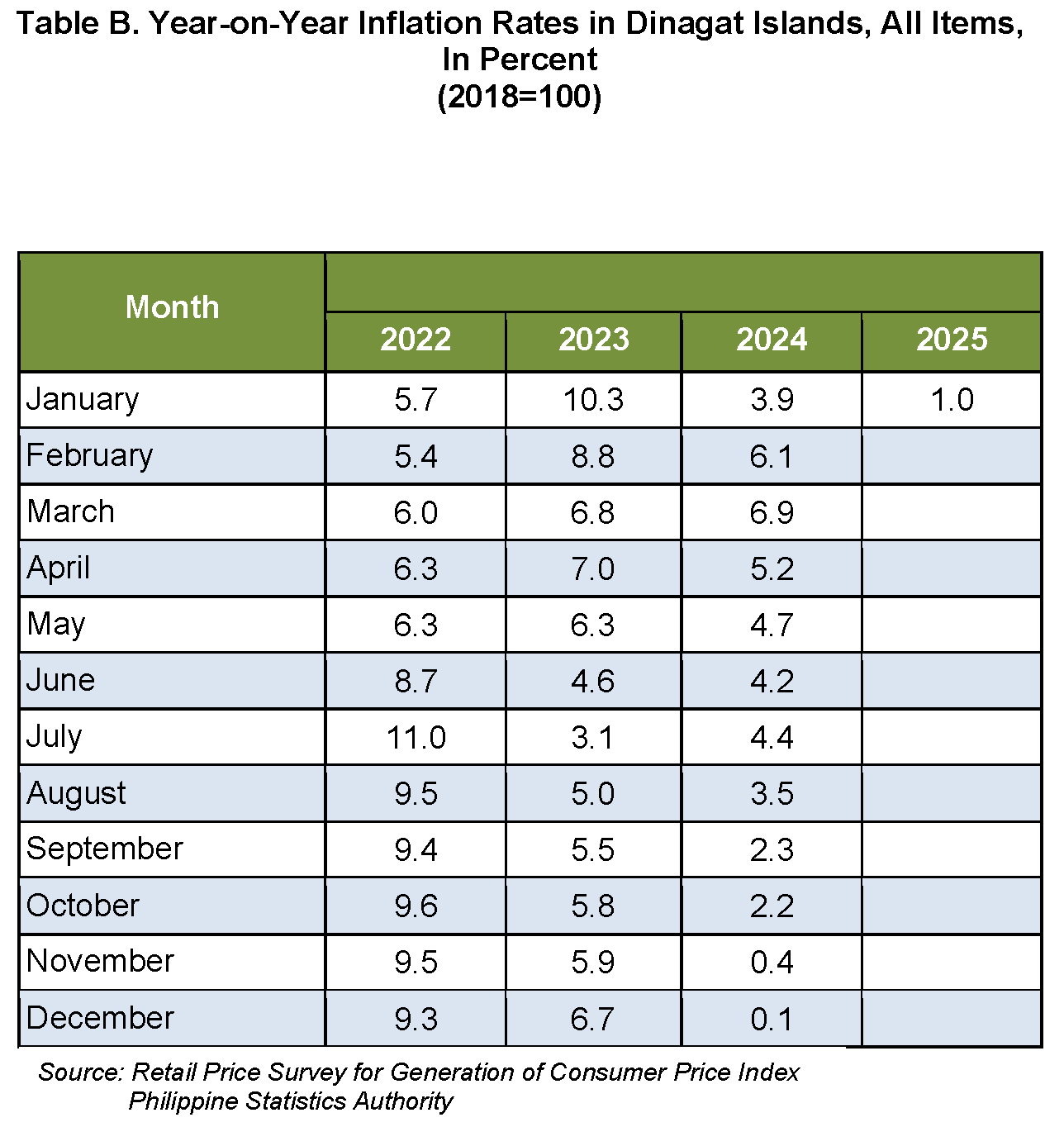

The headline inflation rate in the Province of Dinagat Islands increased to 1.0 percent in January 2025, following a 0.1 percent rate in December 2024. This reflects a 2.9 percentage point reduction compared to the 3.9 percent inflation rate recorded in January 2024. The year-to-date inflation rate averaged 1.0 percent, surpassing both the national average of 2.9 percent and the regional average of 1.4 percent (refer to Table A and Figure 1).

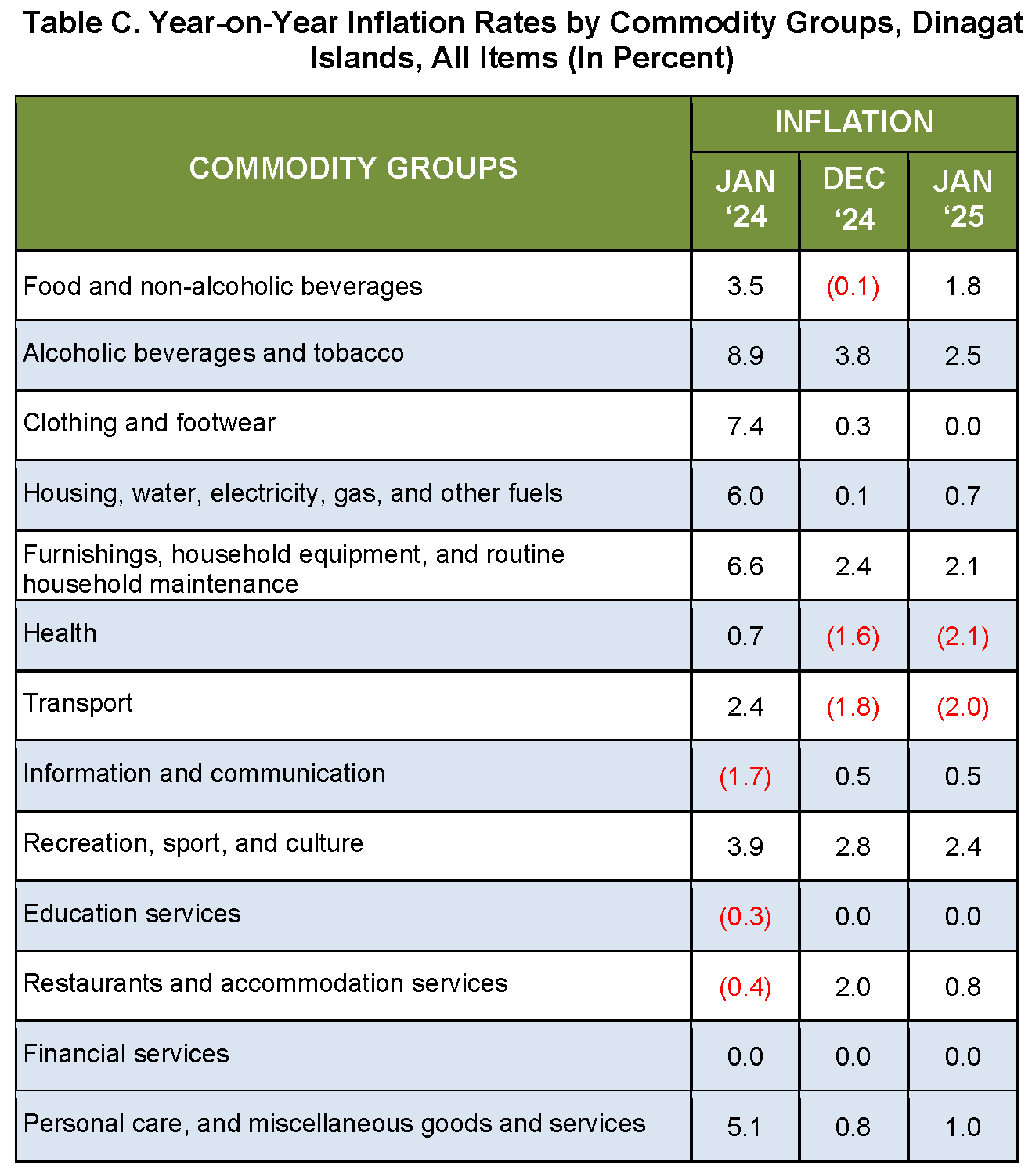

Main Drivers to the Upward Trend in Overall Inflation

The acceleration of inflation in January 2025 was primarily attributed to the Food and Non-Alcoholic Beverages sector, which registered an inflation rate of 1.8 percent. This sector accounted for 90.8 percent of the overall increase in provincial inflation.

The Housing, Water, Electricity, Gas, and Other Fuels sector also contributed significantly, with an inflation rate of 0.7 percent, representing 8.5 percent of the total provincial inflation rate.

Other commodity groups that influenced the rising price indices include:

• Personal Care and Miscellaneous Goods and Services: Inflation rose to 1.0 percent from 0.8 percent in the previous month.

Conversely, some commodity groups experienced price declines:

• Alcoholic Beverages and Tobacco: Inflation dropped to 2.5 percent from 3.8 percent.

• Clothing and Footwear: Inflation decreased to 0.0 percent from 0.3 percent.

• Furnishings, Household Equipment, and Routine Household Maintenance: Inflation declined to 2.1 percent from 2.4 percent.

• Health: Inflation rate fell from 0.0 percent to -2.1 percent, contributing -1.6 percent to the overall trend.

• Transport: Inflation rate dropped to 2.0 percent from 1.8 percent.

• Recreation, Sports, and Culture: Inflation declined to 2.4 percent from 2.8 percent.

• Restaurants and Accommodation Services: Inflation eased to 0.8 percent from 2.0 percent.

Meanwhile, the following commodity groups maintained stable inflation rates for January 2025:

• Information and Communication: Steady at 0.5 percent.

• Education Services: Unchanged at 0.0 percent.

• Financial Services: Remained at 0.0 percent.

Top Contributors to Overall Provincial Inflation

The top contributors to the overall inflation rate in January 2025 for all income households were:

1. Food and Non-Alcoholic Beverages – 1.27 percentage points

2. Housing, Water, Electricity, Gas, and Other Fuels – 0.36 percentage points

3. Restaurants and Accommodation Services – 0.24 percentage points

4. Personal Care and Miscellaneous Goods and Services – 0.14 percentage points

5. Transport – 0.10 percentage points

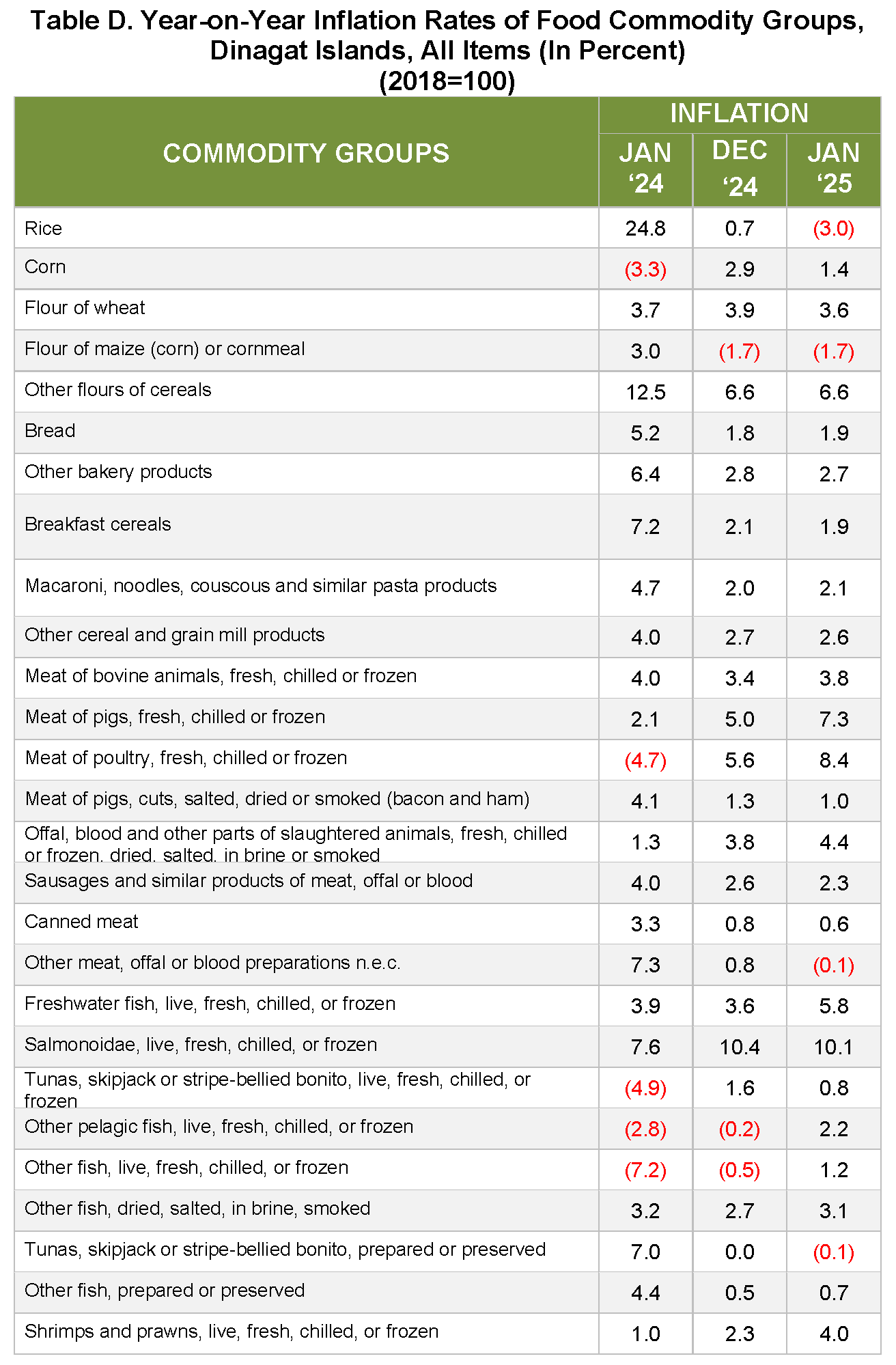

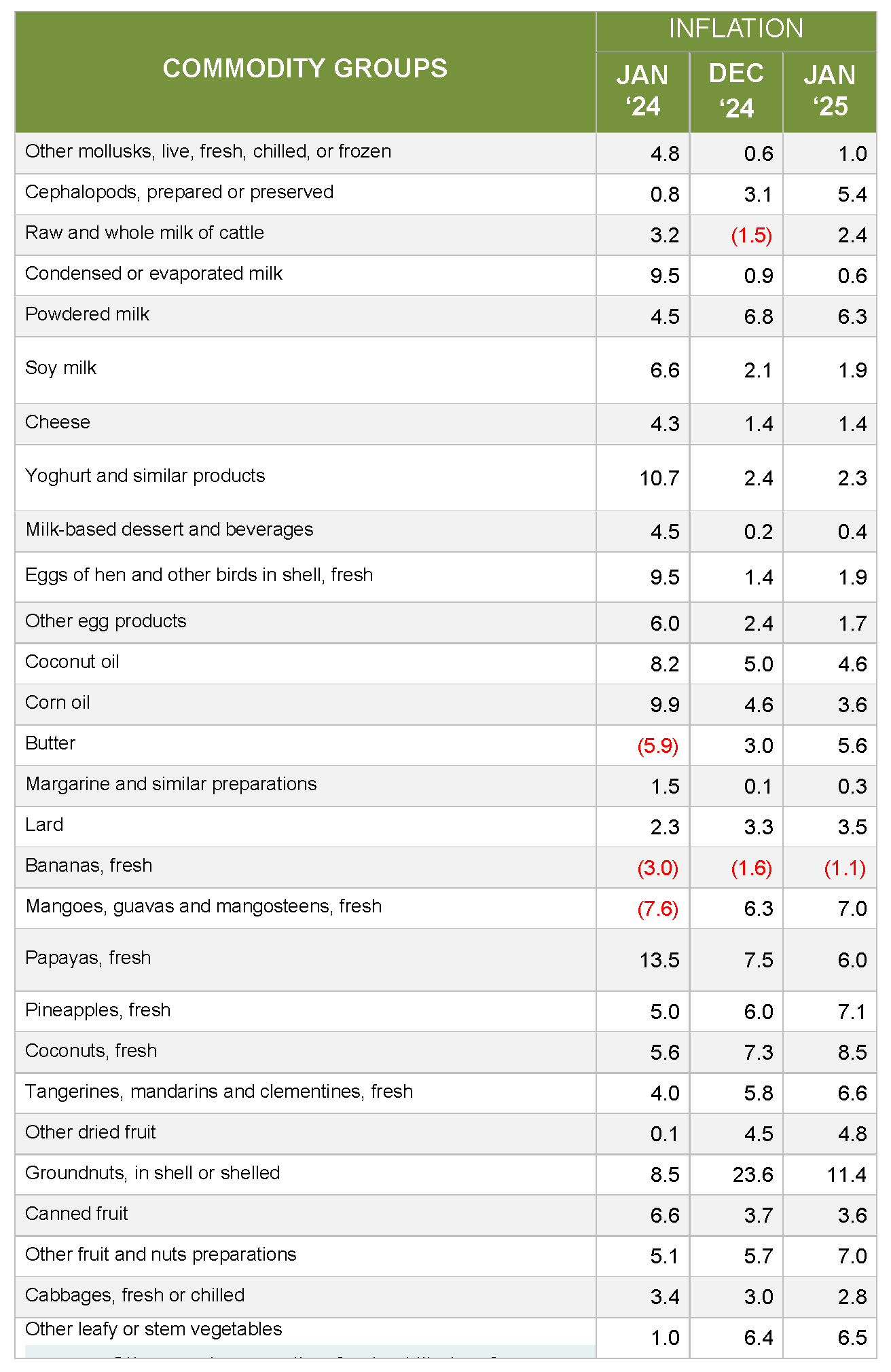

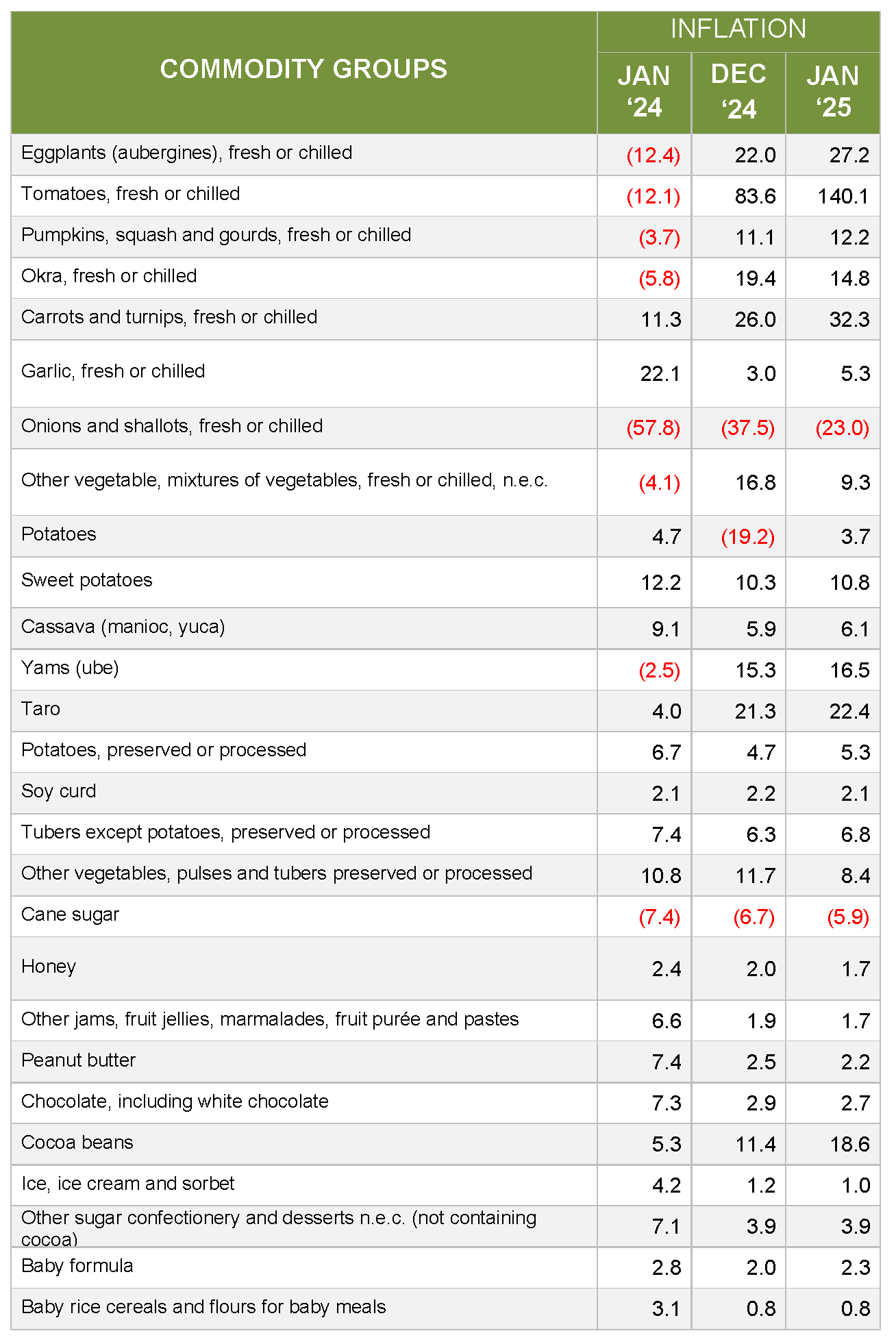

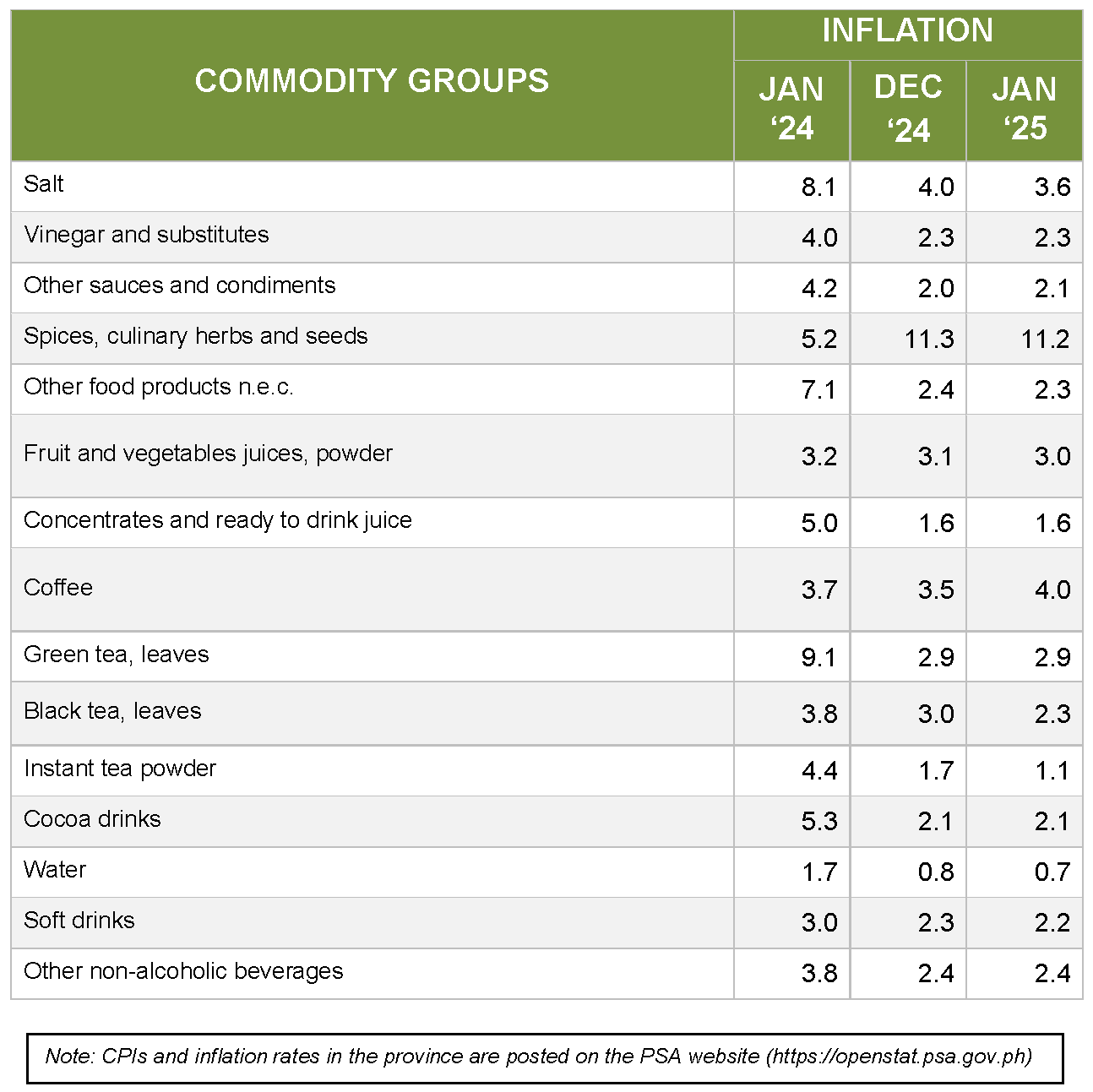

Food Index

The food index in January 2025 exhibited a moderate increase in price levels, rising to 4.0 percent from 3.5 percent in December 2024. The key contributors to this increase were:

1. Vegetables, Tubers, Plantains, Cooking Bananas, and Pulses – Inflation surged to 21.1 percent from 14.2 percent, accounting for 44.8 percent of the overall food inflation.

2. Fish and Other Seafood – Inflation climbed to 3.3 percent from 1.0 percent, contributing 30.2 percent to the total food index.

3. Meat and Other Parts of Slaughtered Land Animals (ND) – Inflation increased to 6.4 percent from 4.9 percent, making up 22.4 percent of overall food inflation.

Purchasing Power of the Peso

The Purchasing Power of the Peso (PPP) in the Province of Dinagat Islands stood at Php 0.73 in January 2025, indicating the peso’s relative value compared to previous periods.

(Sgd.)GLENNBOY C. LISTON

Chief Statistical Specialist

Dinagat Islands-PO

Technical Notes

The Philippine Statistics Authority generates the monthly Consumer Price Index (CPI) based on the nationwide survey of prices for a given basket of goods and services. Two important indicators, the inflation rate and purchasing power of the peso (PPP) are derived from the CPI which is important in monitoring price stability and the value of the country’s currency.

The Consumer Price Index (CPI) is an indicator of the change in the average retail prices of a fixed basket of goods and services commonly purchased by households relative to a base year. It shows how much on the average, prices of goods and services have increased or decreased from a particular reference period known as base year.

The CPI is mostly used in the calculation of the rate and purchasing power of the peso. It is a major statistical series used for economic analysis and as monitoring indicator of government economic policy.

The CPI is also used to adjust other economic series for price changes. Another major importance of the CPI is its use as basis to adjust wages in labor management contracts as well as pensions and retirement benefits.

Inflation rate refers to the rate of change in the average prices of goods and services typically purchased by consumers. It is interpreted in terms of declining purchasing power of money.

The Purchasing Power of the Peso (PPP) indicates the value of the peso in the period under review as compared to the value of the peso in the base period. It is computed as the reciprocal of the CPI for the period under review multiplied by 100.